Non-Circulating Token ‘Treasury’ Wallets in Stablecoin Setups: Purpose, Pros, and Cons

Stablecoins depend on transparent supply management and issuance policies. While many issuers follow a familiar mint and burn lifecycle, some stablecoin systems incorporate an additional component: non-circulating treasury wallets.

Non-circulating treasury wallets hold issuer-controlled balances that are not included in public circulation. Importantly, these tokens held in these wallets are not backed 1:1 by reserves like cash or treasury securities, nor are they intended to. This design choice can offer operational benefits for stablecoin issuers, but it also introduces important considerations for transparency and assurance.

Understanding how treasury wallets function helps stakeholders interpret supply flows, evaluate reporting, and assess the robustness of a stablecoin’s architecture.

What Are Non-Circulating Treasury Wallets?

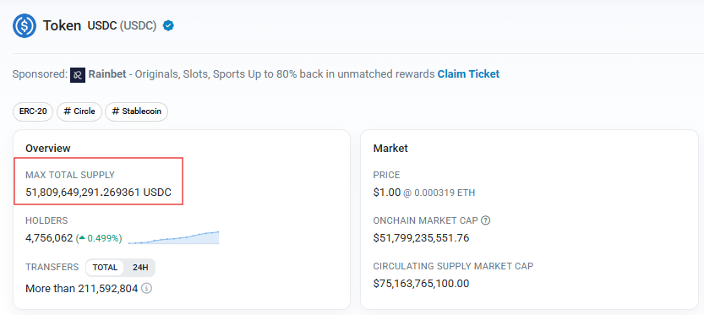

A non-circulating treasury wallet is a blockchain address controlled by the issuer that holds tokens temporarily or permanently outside of “public” circulation. However, when retrieving the total supply balance from a blockchain, these balances would be included within the total supply number. Therefore, disclosure of these non-circulating wallets, and subtracting the balance held therein, is vital when providing transparency into stablecoin reserves. For transparent stablecoin audits and Proof of Reserves attestations, issuers must disclose these non-circulating wallets and subtract their balances from circulating supply figures to accurately represent the true reserve-backed portion of the token supply. This distinction is critical for both blockchain-based accounting systems and traditional financial auditors who verify proof of reserves.

Why Implement Non-Circulating Treasury Wallets into Stablecoin Ops?

These wallets are used by issuers to perform many operational functions, including:

Verifying Token Issuance Prior to External Distribution: Recently, Paxos came under fire for accidently minting 300 trillion of PYUSD. If Paxos were to use a model whereby tokens were minted to a non-circulating treasury wallet prior to external distribution, these tokens may still have been minted, but they would have been tagged as “non-circulating,” and thus not be included in the Total Supply in public circulation, reducing headaches and questions from the public.

Verifying Proper Token Reception Prior to Burning: Often times, each onboarding customer with a stablecoin issuer has a dedicated “burn” address, where tokens are sent to initiate a burn redemption for fiat. However, any entity that has knowledge of the address can send funds to it. Therefore, not all stablecoins received at the dedicated burn address may be valid or initiated by the stablecoin issuer’s customer. Therefore, by receiving funds into a temporary non-circulating wallet, the redemption request can be verified prior to actually burning tokens on chain and distributing fiat as part of the redemption process.

Reduced Fees: On-chain minting and burning actions cost more “gas” than simple “send” transactions on a blockchain. Therefore, some issuers opt to use a non-circulating treasury wallet to remove tokens from public circulation because it is a cheaper alternative to on-chain minting and burning.

These operational benefits become particularly important when issuance and redemption transactions are high, and when dealing with large counterparties whereby secondary verification is beneficial prior to issuance and redemption.

Where Treasury Wallets Fit in the Mint and Burn Lifecycle

The stablecoin supply lifecycle utilizing a non-circulating treasury wallet includes:

Tokens are minted and sent to the non-circulating wallet controlled by the issuer.

Upon a “purchase” or “mint” request by a customer and receiving funds, stablecoins are distributed from the non-circulating treasury wallet to the customer’s wallet, effectively releasing the stablecoins into “public circulation,” requiring a 1:1 reserve backing.

Upon a “redemption” or “burn” request by a customer, stablecoins are received into a non-circulating treasury wallet, but not necessarily burned on chain. Upon confirmation by the issuer that the redemption is appropriate, fiat funds will be sent to the customer to complete the redemption request.

Tokens may temporarily reside into the non-circulating treasury wallet, or the issuer may keep excess tokens therein to function as “float” to support future stablecoin purchases.

In setups where treasury wallets are used, they become an important staging area for supply movement. Clear documentation helps external parties understand how tokens transition between internal and circulating states.

Pros and Cons of Using Treasury Wallets

Treasury wallets introduce both benefits and trade-offs for a stablecoin’s operational design.

✔ Pros

Operational Structure: Issuers can manage mint and burn flows in controlled stages.

Clear Separation of Balances: Issuer-controlled holdings can be distinguished from circulating supply.

Batch Processing Capability: Mint or redemption events can be grouped before final issuance or burning.

Support for Internal Blockchain Accounting: When documented well, they can help maintain clarity across distinct categories of tokens minted.

Reduced Fees: Transactions to and from a treasury wallet are cheaper than on-chain mints and burns.

✘ Cons

Additional Complexity: Creating “backed” and “unbacked” tokens creates additional complexity for external customers to understand which token should be backed and which ones should not be.

Risk of Misinterpretation: External observers may misread public blockchain transfers without proper context.

Why Treasury Wallets Matter for Stablecoin Audits and Attestations

Accurate blockchain accounting and independent stablecoin audits and Proof of Reserve attestations both depend on transparent wallet structures. Treasury wallets play a key role in this assurance ecosystem. When treasury wallets are part of the system, auditors evaluate:

which wallets represent issuer-controlled balances

how tokens move into and out of circulation

how treasury wallet activity is recorded in internal ledgers

how the issuer distinguishes between circulating and non-circulating balances

When issuers use non-circulating treasury wallets, the formula to determine stablecoins in public circulation, and thus what should be backed 1:1 with reserves, is as follows:

Total Supply on Blockchains – Amounts held in Non-Circulating Wallets = Stablecoin Supply in Public Circulation

All of these elements should be clearly and accurately disclosed within the attestations performed by the independent auditor.

Final Thoughts: Building Stablecoins With Transparency at the Core

Treasury wallets are one architectural choice in stablecoin design. For issuers who use them, they play a meaningful role in managing supply and moving tokens between internal and circulating states.

Clear processes, disciplined documentation, and transparent reporting help stakeholders understand these movements and evaluate system stability.

The Network Firm delivers industry-leading audit and assurance for stablecoin issuers and digital asset organizations - helping you earn user trust, meet regulatory expectations, and scale with confidence.

Book a consultation with us today to get started.

Jericho Sarmiento

Author Bio:

Jericho Sarmiento is a Staff Auditor at The Network Firm, where he supports audit and attestation engagements involving digital assets and blockchain-based financial systems. He is a Certified Public Accountant (CPA) with a strong foundation in accounting and assurance.

Jericho brings over five years of professional experience, including one year focused on crypto and digital assets. He has assisted in audit and attestation engagements across industry participants such as exchanges, custodians, and stablecoin issuers. His work includes supporting stablecoin attestations, Proof of Reserves (PoR) procedures, crypto asset verification, and the preparation of detailed audit documentation and workpapers in accordance with evolving assurance standards.

In addition to his professional work, Jericho independently researches smart contract security, focusing on understanding protocol mechanics and analyzing logical behaviors and potential security risks.

Jericho’s professional focus is on applying established accounting and assurance principles to blockchain-based systems, helping ensure digital asset data is verifiable, auditable, and reliable.

Connect with Jericho on LinkedIn for more expert advice.